This is a fascinating story about what upper administration did to the budget at Johns Hopkins, of all places, in response to the COVID-19 pandemic. Summarizing, last spring the administration.

You will be shocked to learn that the Thurston County investigation's finding that Michael Reinoehl probably fired at the officers who killed him is almost certainly bullshit: When a U.S..

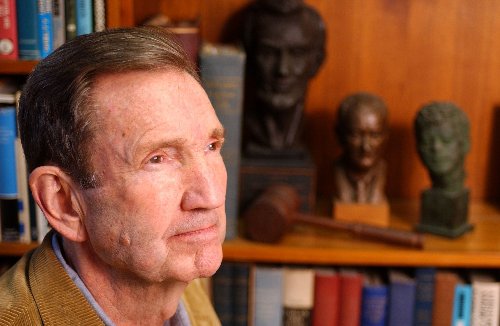

Ramsey Clark has died. One of the most remarkable figures of the late twentieth century, he was a man dedicated to doing what he thought was right and did not.

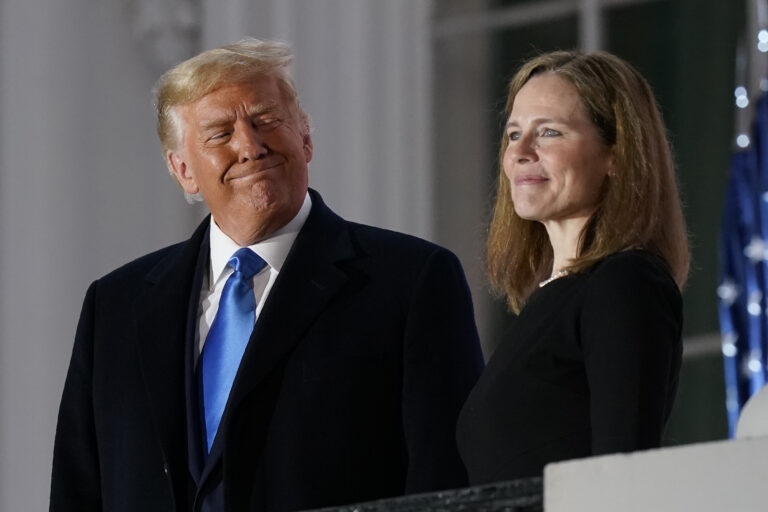

California had a rule restricting all home gatherings, religious, to a maximum of people from three households. The Supreme Court has just thrown out this order in a 5-4 opinion,.

By Fedor Leukhin - _VO_8219, CC BY-SA 2.0, https://commons.wikimedia.org/w/index.php?curid=26608132 It is not difficult to know a thing; what is difficult is to know how to use what you know. China.

This is the grave of Henny Youngman. Born in 1906 in London, he and his family immigrated to New York when he was a child, living in Bay Ridge. He.

Josh Hawley (R-Yale/Stanford) is attacking WOKE capital because people have criticized him for such inoffensive views as "it's good when Donald Trump urges state legislators to steal elections on his.

Fox News's most-watched host went straight to Charlottesville last night: "The left and all the little gatekeepers on Twitter become literally hysterical if you use the term 'replacement,' if you.

- Election of the Day: Bangladesh

- Trump alienates critical swing state

- Pam Bondi needs to be impeached one nanosecond after the Democrats have a House majority

- Put a big yam, in your butt. Some uncooked ham, in your butt…

- It may be what marginal voters should have expected, but it’s not what they wanted

- Be Evil!

- Secretary of Eugenics demands more culling of the herd

- FAA Closes El Paso

- This Day in Labor History: February 11, 1918

- That’s entertainment