A guy don’t walk on the lot unless he wants to buy

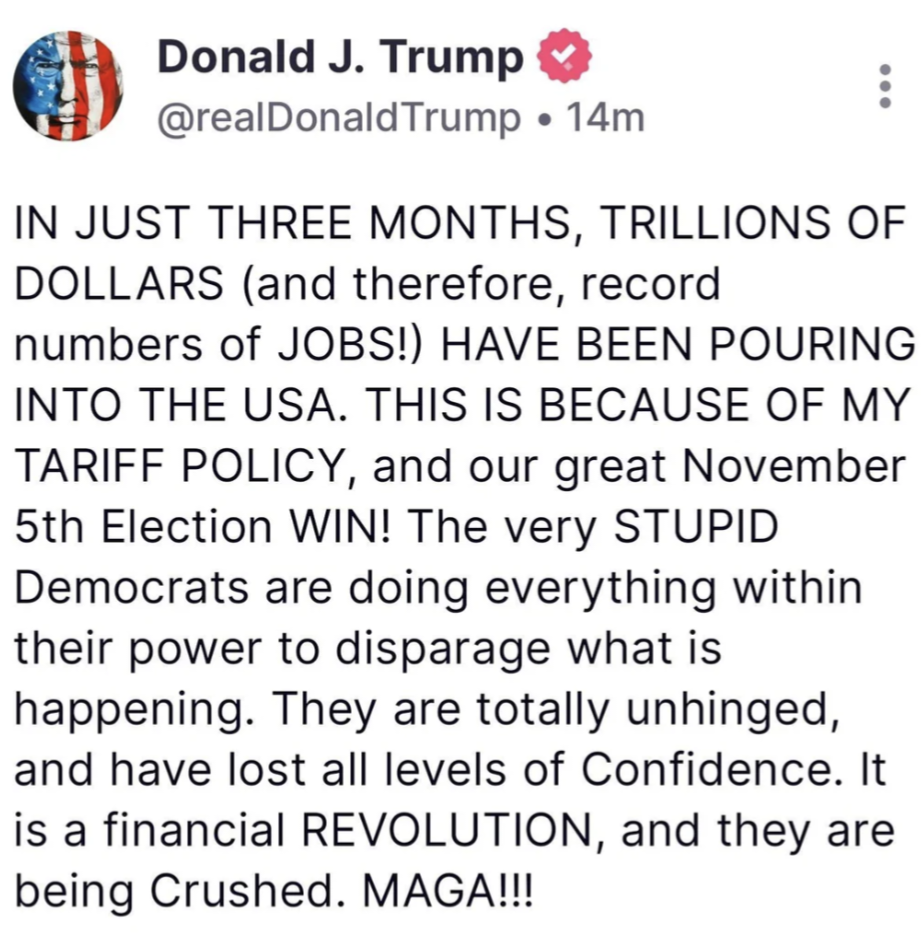

Remember when sky high tariffs were the key to economic prosperity, and might even replace the entire federal income tax? That was the 1890s yesterday.

Global investors are cheering a thaw in the trade war sparked by US President Donald Trump’s massive tariffs, which have roiled financial markets, disrupted supply chains and stoked recession fears.

Stock markets around the world rose Monday after the United States and China agreed to drastically roll back tariffs on each other’s goods for an initial 90-day period.

Hong Kong’s Hang Seng index was up 3.4% late afternoon local time.

In Europe, Germany’s DAX index and France’s CAC were 1.2% and 1% up respectively early in the trading session. London’s FTSE index rose 0.3%.

US futures were also up. The Dow was set to open 2.1% higher, while futures in the S&P 500 and tech-heavy Nasdaq were trading 2.7% and 3.6% higher respectively.

The US dollar strengthened early Monday following the breakthrough in trade talks. The ICE dollar index, which measures the greenback’s strength against a basket of major currencies, rose 1.3% to $102

Stay tuned to find out what it will be next week.

This country is now a timeshare condominium complex with shuttle service to a shitty casino.

Good job media and marginal American voter!

. . . The big mistake with interpreting what Trump does is always to assume there’s some sort of plan here. You can make an argument for protectionism policies that enhance autarky at the cost of efficiency and GDP growth, but none of this has anything to do with those sorts of arguments. This is just random bullshit, with tariffs going high because China is “ripping us off,” but then dropping because the money men don’t like it. Tariff income will be enormous, but we’re going to be economically self-sufficient so we won’t pay them. And on and on. Trying to impose a rational frame on this is its own form of irrationality.