“the republic of tweets is no popular democracy”

Eric Levitz has an excellent piece explaining how a segment of the Extremely Online Left convinced itself — and, alas, possibly some suckers who lost actual money — that coming in at the tail end of a pump-and-dump scheme was actually Sticking It To Wall Street:

Nevertheless, the republic of tweets is no popular democracy. Twitter users are much younger, more educated, and wealthier than the American public as a whole. And those who tweet about politics are, by definition, far more interested in consuming news media than ordinary Americans. These biases shape Twitter discourse and the viral causes that arise from it. Like social media itself, meme-fueled populist uproars are liable to privilege spectacle over substance, the concerns of college-educated young people over those of those less online constituencies, and the hasty embrace of (ideologically affirming) conclusions over the exercise of epistemic humility.

All these distortions were present in last week’s GameStop discourse. As a substantive matter, it was never easy to explain how thousands of people overpaying for GME shares was supposed to threaten the capitalist order. Whatever utility the GameStop rally theoretically had as a spectacle, its first-order consequence was to transfer wealth from ordinary Americans to Robinhood and Wall Street market makers. But patient, careful reasoning about the relative merits of various causes do not drive Twitter engagement; spectacle does. And while the showdown between WallStreetBets and Melvin Capital was not a class war, it did play one on CNBC.

In a social-media discourse that was demographically representative of the nation as a whole, it seems unlikely that the phrase “working-class retail investors” would be spoken unironically. But on a platform that drastically underrepresents the supermajority of Americans who have less than $1,000 in savings, it was possible for some progressives to mistake the cause of recreational investors for that of the proletariat.

Some of the resulting analysis was just howlingly bad:

Put all this together, and you get some balefully misguided progressive discourse. The left-wing activist and Twitter influencer Jordan Uhl appeared to argue on Friday (1) that it is outrageous for the president to suggest that the plight of the unemployed is worthy of his attention but the plight of GameStop bulls somehow isn’t, (2) that restrictions on fee-free day-trading are a leading cause of wealth concentration in the United States, and (3) that it is insulting for the White House to suggest that it is the SEC’s job to regulate Wall Street.

[…]

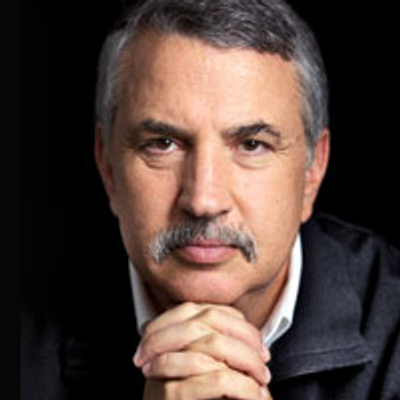

Meanwhile, the leftist gadfly Matt Taibbi seems to have been too infatuated with the spectacle he saw playing out on CNBC to recognize that he was absorbing the network’s Hayekian economic assumptions. In a paean to WallStreetBets, Taibbi derided the Federal Reserve’s “zero-interest-rate policies” as “artificial stimulants” that are preventing “zombie companies” — which account for roughly 30 percent of all U.S. corporations — from going out of business. This argument implies that there is some “natural” benchmark interest rate that exists outside of politics and policy, and that the Fed is corruptly flouting this natural market law, just so it can prevent nearly one-third of America’s large employers from going bust. In other words: Taibbi is making a libertarian argument for central banks to tolerate deeper recessions and higher unemployment, so as to avoid corrupting natural market forces with “artificial stimulants.” It’s the kind of thing one might expect to find in a column by Taibbi’s archnemesis, Thomas Friedman; in fact, it is literally the argument of Friedman’s latest column.

These analytical errors matter. If the ethos of social media leads the left to prize populist sentiment over progressive substance, then its energies will be ripe for misdirection by reactionary forces. Condemnations of the Fed for bailing out corporate America with its easy money policies can sound populist. But their policy implications are brutally regressive. Rallying to the cause of Robinhood traders may feel righteous. But it also has led leftwing lawmakers to the precipice of endorsing deregulation to facilitate riskier recreational speculation.

Combining this with their fetish for bipartisanship as an end in itself — Ted Cruz, progressive ally! — Taibbi and Greenwald have fully morphed into the Mustache of Understanding. Sad.