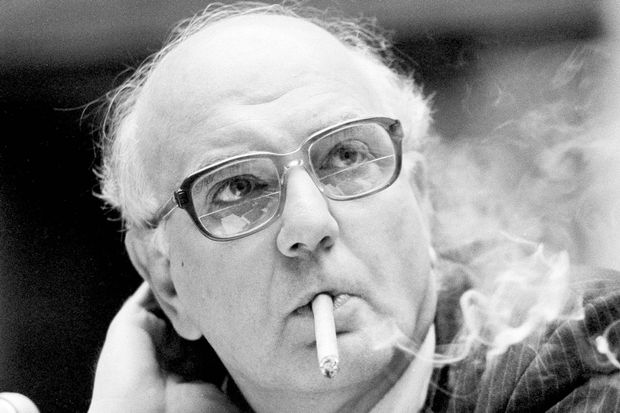

Volcker

Paul Volcker is dead. It’s worth remembering briefly just how responsible he is for many of the problems we face today. The first thing I remembered when I heard he died was a conversation I had a couple of years ago with the wife of a college president (not mine). Basically, we started talking and somehow she said something about inflation. I told her in response that we really needed somewhat higher inflation, that it would help students pay off their loans, etc. The horror on her face was a sight to behold and I found it very funny.

It’s not as if I am downplaying the role of inflation in the 1970s. When you have inflation clocking at well above 10%, that’s a problem. A fix was needed. The first major problem I have with Volcker and his kind is that thanks to them, we have vastly overlearned the lessons of the 1970s. The people who rule our economy will go to any lengths to hold down inflation, no matter the cost to people. Nothing matters more. Never mind that inflation is simply one of many issues that a balanced economy has to manage, nothing else really matters. Never mind that the global and national economies are vastly different than they were forty years ago. That’s an irrelevancy for those who subscribe to the religion of no inflation. To some extent, it’s like the Populists trying to argue with the laissez-faire establishment of the first Gilded Age that their problems were real and needed relief. So when they managed to semi-takeover the Democratic Party in 1896 with Bryan’s silver beliefs, the economic elite absolutely freaked out that the barbarians were at the gate and they really developed the first modern political election campaign to be sure McKinley won and principles were held to. Once again, we are in an era where people have real financial problems that some inflation (not 20%, but maybe 6-7%) would help alleviate those issues. And once again, economic-religious doctrine gets in the way of any policies that would help working Americans. Volcker has no responsibility for that.

Moreover, Volcker really reveled it. He was happy to cause pain in order to achieve his desired goals. He stated, “The standard of living of the average American has to decline,” leading he and others in the Carter administration to declare fairly open war on the unions helping Americans increase their standard of living. It was Volcker who first brought the ideas of Milton Friedman into the American government when the former took over the Federal Reserve. Carter’s team initially did not want to pick Volcker for the job because he was so rigid and was “very right wing.” Volcker’s own strategies to fight inflation didn’t even work and he helped bring down Carter through making people feel the pain of fighting inflation. Volcker himself blamed Carter for it all. The obsession with fighting inflation led to the recession in 1982. Eventually, inflation did decline, but not only did it come with a huge spike in the unemployment rate, but with Volcker wrongly getting credit for ending inflation, his views became orthodoxy and remain so today.

In truth, managing a modern economy is tremendously complicated. What does not help is fundamentalists such as Volcker. Maybe someday, the damage he caused will be reckoned with by a new generation of people running the national economy, in the media, and with the public who pays attention to issues like this. Until then, we continue to learn the wrong lessons from Volcker and everyday Americans suffer because of it.