Mark Joseph Stern has a good thread on how absolutely insane Roger Benitez's opinion striking down California's assault weapons ban is: The portion of Benitez's opinion blithely trivializing the unique.

As the Bundys and their merry band of fascists descend on the Klamath River to try and start another war with federal officials there, the reality is that the Klamath.

The latest war between Israel and Palestine has come to its usual conclusion. But before it fades into the oblivion of our memory like most of the small wars over.

A starboard bow view of the Soviet Kirov class nuclear-powered guided missile cruiser KALININ. Yesterday's gone on down the river and you can't get it back. Oh Niall Ferguson should.

For today's podcast, I was happy to speak to two of the long-time fighters to expand Social Security, Nancy Altman and Eric Kingson, about their new book, just out from.

This is the grave of [spit] Lee Atwater. Unfortunately born in 1951 in Atlanta, possibly one of the worst moments in the history of the early Cold War for the.

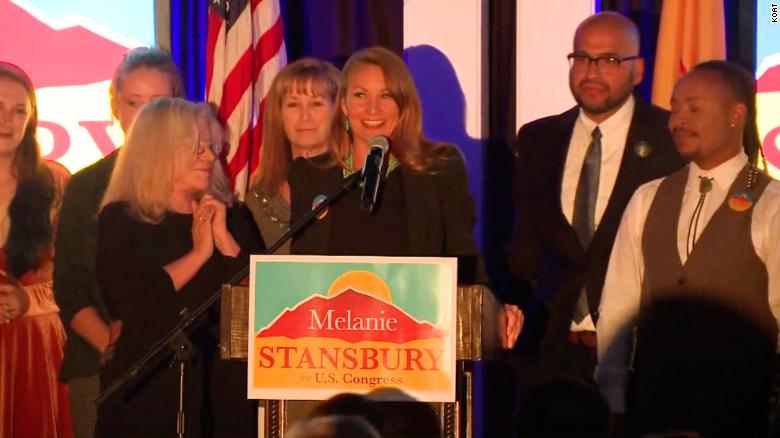

The real political nerds follow special elections for hints of what is to come in 2022. There's been a few. The most important one was for New Mexico-1, replacing Deb.

People take part in a rally on April 29, 2015 at Union Square in New York, held in solidarity with demonstrators in Baltimore, Maryland demanding justice for an African-American man.

- Will the Trump presidency collapse over the next 35 months?

- Erik Visits an American Grave, Part 2,081

- Faux News: Epstein “mostly just a fixer,” mostly

- Vinay Prasad, child murderer

- The Primary Calendar

- How Exploiting Pathetic Male Addicts Took Over the Economy

- Why there will be a government shutdown over DHS

- The Epstein Files and Russiagate

- The Many Faces of Jeffrey Epstein

- Epstein blast radius and the mainstreaming of extreme misogyny