Gentlemen prefer bonds

Some comments on Trump’s suggestion that he’ll reduce the national debt by getting creditors to take a haircut:

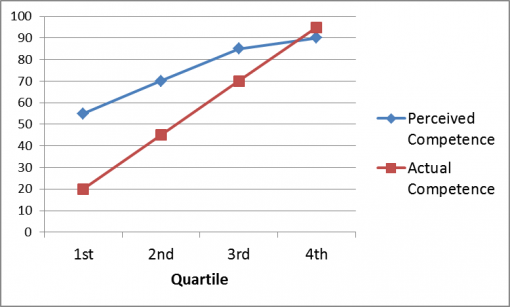

Donald Trump is an ignorant fool. He doesn’t know anything about anything, and worse yet he doesn’t know that he doesn’t know anything about anything. (In psychology, this is known as the Dunning-Kruger effect). The sum total of his talents consists of having the foresight to be born to an immensely wealthy father, and possessing a Rain Man-style idiot-savant capacity for self-promotion. That’s it.

A couple of days ago he provided a frighteningly clear illustration of the bottomless depths of his ignorance when he suggested that he might reduce the national debt by using his deal-making skills to get America’s creditors to accept less than full payment for the nation’s debt obligations to them.

That is an idiotic suggestion, which could only be made by someone who has no idea how bond markets, the American legal system, and the world economy work. . .

In the wake of his mind-blowingly stupid comments, some observers have tried to rationalize Trump’s astonishing ignorance. For example, Matt Yglesias writes that “Trump is a businessman, and in terms of thinking like a businessman his idea makes sense.” The idea here is that it sometimes makes sense for a business to threaten not to pay its debts, because if it files for bankruptcy creditors will get little or nothing. Creditors will then accept what in the trade is known as a “haircut” – less than what they’re legally owed – to avoid this outcome.

But this is giving Trump far too much credit. Real businesspeople, as opposed to a lifelong self-promoting scammer like Trump, understand perfectly well that public and private debts are not equivalent, and that governments (and most especially the U.S. government) can’t operate like private businesses in regard to their debt obligations. That is why real businesspeople invest in U.S. bonds, despite their current near- zero rate of return: because they know that the U.S. government — assuming it isn’t taken over by the maniacs at the head of the contemporary Republican party – can’t and won’t engage in strategic default.

(After the storm of criticism his comments provoked, Trump characteristically claimed this morning not to have said what he clearly did say).

Yglesias’ reaction is an understandable defense mechanism; it’s one that we’ll be seeing a lot of between now and November. He can’t allow himself to contemplate just how ignorant Trump really is, because that would force him to contemplate the extent to which the Republican party has actually gone mad. In other words, Donald Trump’s impending nomination is merely a symptom of a much deeper disease.