Author: Erik Loomis

The answer is almost certainly no because Republicans hate working families. But the overturning of Roe has at least led a few Republicans to take their rhetoric about family values.

New York Jets owner Woody Johnson speaks during a press conference in April at the team's practice facility in New Jersey One of the many ways the strongest nation in the.

I recently watched Sam Peckinpah's Ride the High Country for the first time in several years. It's still a classic, but a couple of things struck me. First, Joel McCrea.

This is the grave of Isaac Barnard. Born in 1791 in Aston Township, Pennsylvania, Barnard came from an old Pennsylvania family that had emigrated from France in the 1680s. He.

Wounded soldiers after the Battle of the Wilderness, May 1864

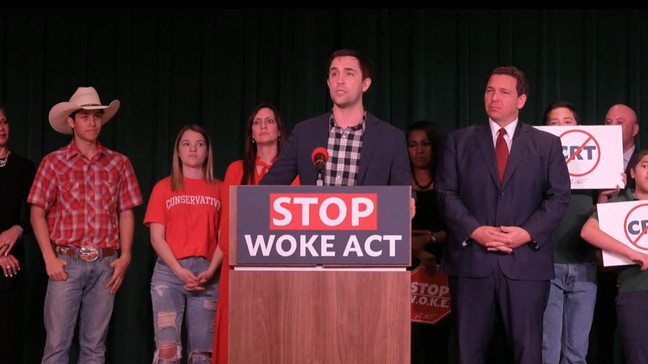

If I taught in Florida, no question I'd be worried for my job. But here's my question for those who teach in Florida: What are you going to do? Because.

The damage Trump did to the EPA is inestimable. And yet, it's worth noting that this is one of the many, many issues where there is no difference between Trump.

This is the grave of Annie Webb Blanton. Born in 1870 in Houston, Texas, Blanton grew up pretty well off, though her mother died when she was 12. By that.